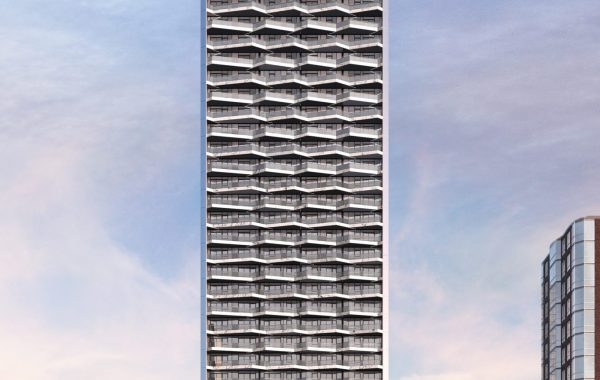

Presale Projects in Vancouver area

There is more under construction projects in the lower mainland, please contact me for detail.

Pre-sale Condominioms

Thinking of buying pre sale condos?

A pre-sale condominium is a townhouse or apartment that is available for purchase prior to it’s construction or before it is move-in ready. Buying a Pre-Sale has many benefits:

- Pre-sale homes come with extensive warranty protection;

- you don’t start paying the mortgage until completion of the building, thereby getting the chance to potentially save for the balance of the down payment; and

- if prices rise over time (which they have done consistently for the past 15 years (except for 2007- 8), your new home will be worth more than what you paid for it – before you take possession!

However it’s equally important to be aware of the risks associated with pre-sales so you can make an informed choice to buy or not.

Here are 10 things you need to know before you do.

So you’re thinking about buying pre sale condos here in Vancouver. There are many pros and cons of pre sale condos in Vancouver. You get the peace of mind of having something brand new, but there are also additional costs and the uncertainty of what you will end up with upon completion. You’re about to invest in a pile of dirt, buyer beware.

- You need to be aware that all pre sale condos are subject to 5% GST on top of the purchase price. This is a significant additional cost so make sure you factor it in. If you’re a first time buyer you are eligible for a rebate of 36% if it’s under $350,000. Anything from $350-450,000 will be subject to a portion of that rebate. There can also be builder closing costs upon completion. It’s important to review your contract to determine what they will be

- There is no guarantee of financing. You can get pre-approved for financing of the condo, however should your financing situation change (losing your job) before closing, you are still required to close.

- Timelines can change. Even though the developer may tell you it’s expected to be ready at a certain time, deadlines always change. It’s extremely rare to see a development actually finish ahead of time, let alone on time. Expect delays, and plan for a delay of at least a couple months.

- If you’re thinking about assigning the contract, in simpler terms selling the condo before completion, you need to know the developers restrictions. Developers can often be quite strict on this and won’t allow you to assign your contract until all the units are sold out. Sometimes you will be charged a fee for doing so, or any profit on the assignment will go straight to the developer. Marketing of the assignment can be quite restricted. Many times they will not allow it to be advertised on the MLS.

- If the market collapses before completion and the value of your pre-sale condo is worth less than you paid you are still obligated to close! This is the risk you run. Thankfully the Vancouver housing market has been increasing in value on a consistent basis so the risk there is minimal.

- The size of the condo unit can change. The finished unit can end up being smaller than originally agreed upon. The developer has an obligation to complete the project to be as precise as possible, they are allowed to have a 97% accuracy. In other words if they sell you 600 square feet they can legally build you 582 square feet. Building plans can change and buyers have to be ok with that. They could tell you the communal pool will be built on the roof and things could change and it ends up in the lobby.

- When buying directly from the developer there are no restrictions. This is why many investors love pre-sales. This holds up even if rental or pet restrictions are created when the strata corporation is formed. Important to note, once you sell your unit the new owner will then be subject to the current strata restrictions and not the restriction free privileges you had when you bought brand new off the developer.

- You get a 7 day due diligence period. This means once the contract is signed you get 7 days to decide if you really want to go ahead, to get financing in place and any other things you may need to review. I highly suggest you have a lawyer look over the entire contract during this time.

- You might be able to secure additional parking and or storage during pre-sale. Developers will often sell additional parking and storage during pre-sales. In Vancouver, parking spaces are becoming more and more of a premium. If you can secure 2 it’s probably worth it.

- Know what the payment structure for the building is. New developments have a different payment structure than your normal purchase. For example, the developer will usually ask for 1% of the purchase upon signing the contract. Another 9% is charged after the 7 day due diligence. Generally an additional 5-10% is required several months later.

Important side note: There is no deal if you buy directly from the developer. Despite popular belief, the builder has budgeted that he will be paying both Realtor commissions so should you decide to buy direct, any savings would go straight to the developer and not you. You can and should try to negotiate any desired finishings. This is where a Realtor’s experience will be beneficial. The developer’s Realtor has zero fiduciary duty to look out for your best interests, they are working for the developer.